Written to help you do a better job of managing your personal and family financial affairs and to help you get more for your money. You get ideas on saving, investing, cutting taxes, making major purchases, advancing your career, buying a home, paying for education, health care and travel, plus much, much more. Special issues cover the latest information about car buying (December) and Mutual Funds (March and September).

Figure out your next move. • Profit in your business and investments. Get concise weekly forecasts on business, the economy, and more.

The Rising Cost of Insurance

Find Your Retirement Paradise

Kiplinger’s Personal Finance

THE LONG TAIL OF HIGH INTEREST RATES • College students will pay more to borrow. Savers will continue to benefit but need to remain vigilant.

ASK FOR THE SALARY YOU DESERVE • More employers are posting salary ranges, which you can use to determine whether your paycheck is competitive.

TAX BREAKS ON BACK TO SCHOOL SHOPPING • Some states temporarily lift sales taxes on backpacks, laptops, clothing and more.

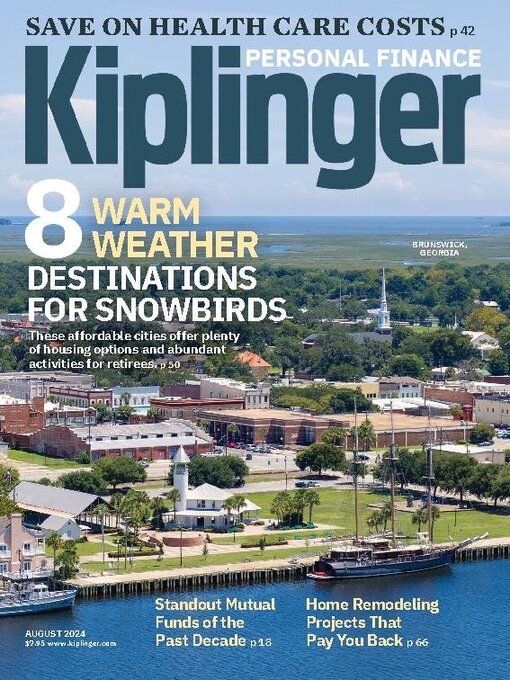

AUGUST 2024

Briefing • INFORMATION ABOUT THE MARKETS AND YOUR MONEY

Prices for Electricity Will Keep Rising

ANOTHER MILESTONE FOR STOCKS

CATEGORY LEADERS • These mutual funds have racked up peer-beating returns over the past decade.

SEEKING DEPENDABLE PROFITS • These five stocks have a solid growth history and a promising outlook.

THE CASE FOR COMMODITIES • These portfolio diversifiers are in a long-term uptrend.

Bad News Is Good for Insurers • STREET SMART

DIVIDENDS HOLD UP FOR OUR FAVORITES • THE KIPLINGER DIVIDEND 15 UPDATE

A STEADY FUND IN A VOLATILE MARKET • KIPLINGER 25 UPDATE

The Beauty of Bond Ladders • INCOME INVESTING

A BRIGHTER VIEW ABROAD • ETF SPOTLIGHT

UTILITIES POWER AHEAD

Keep kids reading all summer long!

SAVE MONEY ON HEALTH CARE • Now is a good time for a midyear review of your health insurance coverage to make sure you’re getting the most out of it.

A Tax Break for High Medical Expenses

Plan for Open Enrollment

Pros and Cons of Brokered CDs

HOW COUPLES CAN BLEND FINANCES • KIPLINGER ADVISOR COLLECTIVE

8 GREAT PLACES FOR SNOWBIRDS TO LAND • These affordable warm-weather cities offer plenty of housing options, abundant activities for retirees and access to good health care.

Singles Share Ways to Connect

WATCH THESE BELLWETHER STOCKS • We found six companies that are weathervanes for their industries or the economy.

Make It Easier for Your Heirs to Manage Your Estate • Organize your financial paperwork and make sure your family knows how to find it.

Key Documents to Share With Your Family

A REALISTIC WAY TO ADJUST YOUR BUDGET • If essential expenses take up a big chunk of income, this method offers flexibility.

Enjoy a worry-free retirement… and the lowest price we offer.

REMODELING PROJECTS THAT PAY OFF • These renovations will give your home a fresh look—and they provide a decent return on investment, too.

WHAT TO LOOK FOR WHEN YOU HIRE A CONTRACTOR

SPENDING LESS AND REDUCING WASTE, TOO • Through Buy Nothing community groups, locals give and receive items free of charge.

Mar 01 2026

Mar 01 2026

Feb 01 2026

Feb 01 2026

Jan 01 2026

Jan 01 2026

Dec 01 2025

Dec 01 2025

Nov 01 2025

Nov 01 2025

Oct 01 2025

Oct 01 2025

Sep 01 2025

Sep 01 2025

Aug 01 2025

Aug 01 2025

Jul 01 2025

Jul 01 2025

Jun 01 2025

Jun 01 2025

May 01 2025

May 01 2025

Apr 01 2025

Apr 01 2025

Mar 01 2025

Mar 01 2025

Feb 01 2025

Feb 01 2025

Jan 01 2025

Jan 01 2025

Dec 01 2024

Dec 01 2024

Nov 01 2024

Nov 01 2024

Oct 01 2024

Oct 01 2024

Sep 01 2024

Sep 01 2024

Aug 01 2024

Aug 01 2024

July 2024 Double Issue

July 2024 Double Issue

Jun 01 2024

Jun 01 2024

May 01 2024

May 01 2024

Apr 01 2024

Apr 01 2024